How to Prepare for a Finance Account Specialist Job Interview: A Finance Account Specialist plays a crucial role in managing a company’s financial operations, ensuring accuracy in transactions, and maintaining compliance with financial regulations. This position requires expertise in handling various financial tasks, including bookkeeping, financial reporting, and tax management.

Employers seek professionals who can analyze financial data, detect inconsistencies, and provide strategic financial insights. The role is essential for maintaining an organization’s financial health, as specialists help in budgeting, forecasting, and ensuring that all financial activities align with the company’s goals. In many companies, Finance Account Specialists work closely with accountants, auditors, and financial managers to streamline operations and optimize financial performance.

|

Key Takeaways

|

Understanding the Role

Beyond technical skills, professionals in this role must possess a strong understanding of financial principles and industry trends. Since the financial landscape is constantly evolving with changes in tax laws, accounting standards, and reporting requirements, staying updated is essential.

The position also requires excellent communication skills, as specialists often interact with various departments, clients, and regulatory authorities. Whether working in a corporate finance department, a financial services firm, or an outsourced accounting agency, Finance Account Specialists contribute significantly to decision-making processes by providing accurate and timely financial data.

Key Responsibilities

The primary responsibility of a Finance Account Specialist is to manage financial transactions and ensure that the organization’s financial records are accurate and up to date. This involves overseeing accounts payable and receivable, processing invoices, reconciling bank statements, and maintaining general ledger accounts. Specialists are also responsible for preparing financial reports, which include balance sheets, income statements, and cash flow statements.

These reports are crucial for management to make informed financial decisions. Additionally, specialists help in budgeting and forecasting, ensuring that financial plans align with business goals. They may also be tasked with identifying cost-saving opportunities and analyzing financial data to improve efficiency.

Beyond transactional tasks, Finance Account Specialists play a key role in regulatory compliance. They ensure that all financial activities adhere to local and international accounting standards, such as IFRS or GAAP. Tax compliance is another critical aspect, as specialists must calculate tax liabilities, file returns, and ensure timely tax payments.

In some organizations, they may assist in audits by preparing documentation and coordinating with external auditors. The role also demands collaboration with different departments, such as procurement and HR, to ensure seamless financial operations. Strong attention to detail, problem-solving skills, and the ability to manage multiple financial tasks simultaneously are essential for excelling in this position.

Required Skills & Certifications

A Finance Account Specialist must possess a diverse set of skills to handle financial operations efficiently. Strong analytical skills are essential for interpreting financial data and making informed decisions. Proficiency in accounting software such as QuickBooks, Tally, SAP, or Oracle is often required, as these tools streamline financial processes.

An understanding of taxation laws, compliance regulations, and financial reporting standards is also critical. Additionally, specialists should have excellent problem-solving abilities to address discrepancies in financial statements and resolve accounting issues. Attention to detail is another crucial skill, as even minor errors in financial transactions can lead to significant consequences for an organization.

In addition to skills, earning relevant certifications can enhance a candidate’s credibility in the finance industry. Certifications such as Chartered Financial Analyst (CFA), Certified Management Accountant (CMA), or Association of Chartered Accountants (ACA/ACCA) demonstrate expertise in financial management and accounting principles.

A Diploma in Financial Accounting (DFA) can also be beneficial for those looking to strengthen their technical knowledge. Many employers prefer candidates with these certifications as they validate a candidate’s proficiency in finance and accounting. Continuous learning through certifications, workshops, and finance-related courses helps professionals stay competitive in the evolving financial sector.

Other Job Requirements

To become a Finance Account Specialist, candidates typically need a strong educational background in finance or accounting. A bachelor’s degree in Commerce (B.Com), Finance, or Accounting is usually the minimum requirement, though many employers prefer candidates with a Master’s degree (M.Com, MBA Finance) for advanced positions.

Work experience in financial management, accounting, or a related field is also highly valued. Candidates with at least two to five years of relevant experience have better chances of securing higher-paying roles. Familiarity with financial regulations, ERP software, and financial modeling tools is an added advantage in this competitive job market.

Apart from formal education and work experience, proficiency in Microsoft Excel and data analysis tools is crucial for managing financial reports and forecasts. Many organizations also look for candidates with hands-on experience in using financial planning software and enterprise resource planning (ERP) systems like SAP and Oracle.

Strong communication skills are important, as Finance Account Specialists often need to explain financial concepts to non-finance teams. Employers also appreciate candidates who demonstrate a proactive approach to financial problem-solving and strategic planning. The ability to work under pressure, meet deadlines, and maintain financial accuracy is essential for excelling in this role.

Resume Generation Tips

Creating a well-structured resume is vital for securing an interview as a Finance Account Specialist. The resume should begin with a compelling summary that highlights relevant experience, skills, and achievements. It is important to use a clean and professional format, ensuring that key details are easily accessible.

The work experience section should focus on quantifiable achievements, such as improving financial reporting accuracy, optimizing accounts payable processes, or successfully managing audits. Listing specific accounting tools and software proficiency can also help strengthen the resume.

Including certifications, technical skills, and industry-related keywords can improve the resume’s visibility in applicant tracking systems (ATS). Additionally, candidates should emphasize soft skills like problem-solving, teamwork, and attention to detail. Avoid lengthy descriptions and keep the document concise—ideally, one to two pages.

A well-crafted resume should also include an education section highlighting degrees and certifications relevant to finance and accounting. Before submitting, candidates should thoroughly proofread their resumes to eliminate errors and ensure clarity. Attaching a cover letter that aligns personal expertise with the company’s financial needs can further enhance job prospects.

Interview Preparation Tips

Preparing for a Finance Account Specialist interview requires thorough research and practice. Candidates should start by understanding the company’s financial structure, industry trends, and competitors. Reviewing common finance-related interview questions and practicing responses can help boost confidence.

Employers often ask situational and behavioral questions to assess problem-solving abilities, so preparing real-life examples of financial challenges and solutions is crucial. Additionally, candidates should be ready to demonstrate their technical knowledge by explaining financial statements, discussing taxation laws, and showcasing their expertise in financial analysis.

Mock interviews and self-assessment exercises can help improve communication skills and clarity of thought. Dressing professionally and maintaining a confident demeanor during the interview also create a positive impression. It is advisable to prepare questions about the company’s financial processes and growth strategies to demonstrate genuine interest in the role.

Candidates should also stay updated with regulatory changes and financial market trends, as employers often expect them to have a comprehensive understanding of industry developments. A well-prepared candidate who exudes confidence and expertise has a higher chance of securing the job.

Average Salary for Finance Account Specialists in India

The salary of a Finance Account Specialist in India varies based on experience, industry, and location. Entry-level professionals with minimal experience typically earn between ₹3-5 lakh per annum (LPA).

Those with two to five years of experience can expect salaries ranging from ₹6-10 LPA, depending on the employer and job responsibilities. Finance specialists working in large multinational corporations (MNCs) or the banking sector often receive higher compensation compared to those in smaller firms.

For senior-level Finance Account Specialists with over five years of experience, salaries can reach ₹10-15 LPA or more. In specialized roles that require expertise in taxation, auditing, or financial strategy, salaries may go even higher. Professionals with additional certifications such as CFA, CMA, or ACCA have better salary prospects.

Additionally, factors such as industry demand, company financial stability, and negotiation skills also influence compensation. Candidates aiming for better salaries should focus on gaining specialized skills, obtaining certifications, and expanding their professional network in the finance industry.

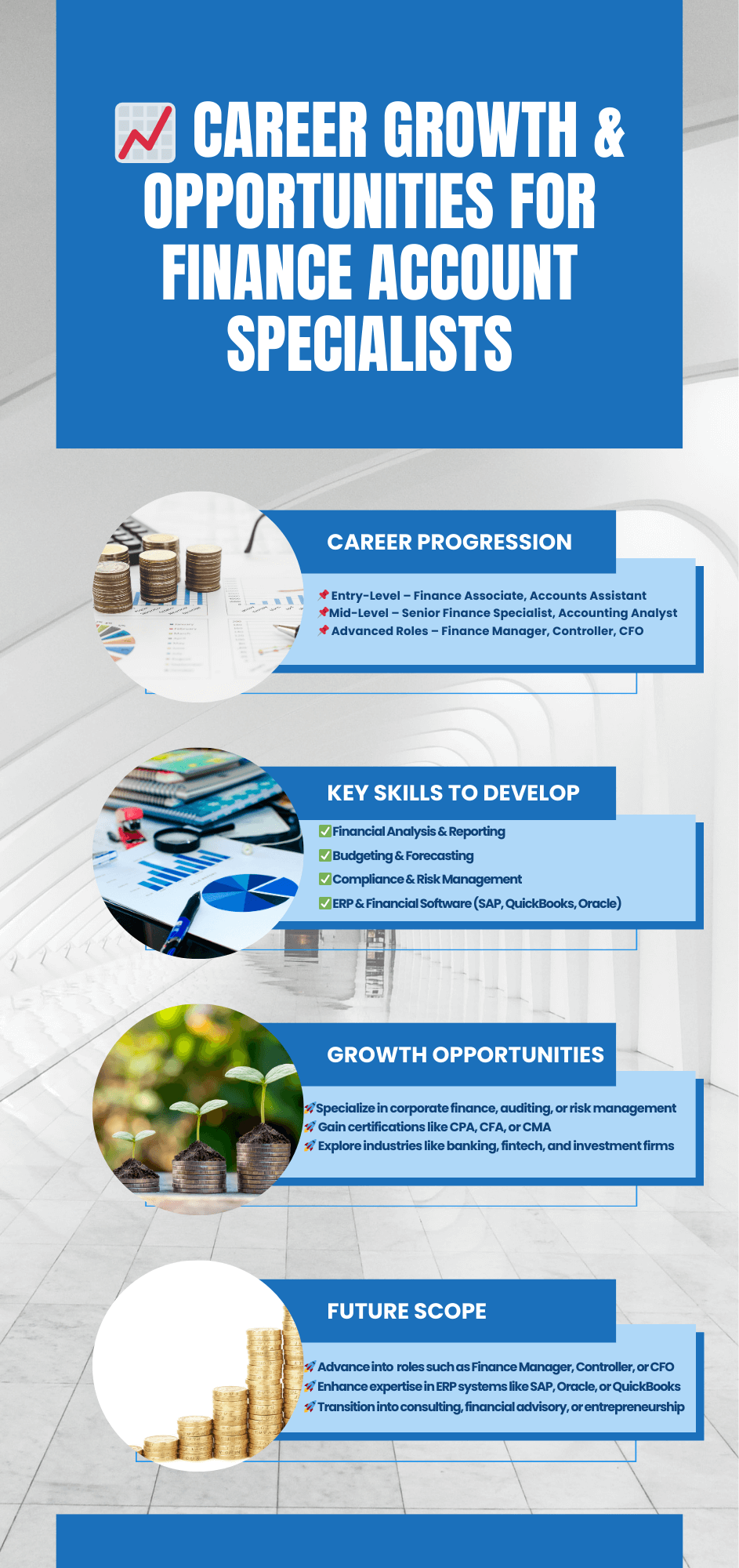

Career Growth and Opportunities

A Finance Account Specialist role offers numerous career advancement opportunities, making it an excellent starting point for professionals looking to build a strong career in finance. Initially, specialists focus on handling financial transactions, reconciling accounts, and ensuring compliance with accounting standards.

However, with experience and additional qualifications, they can move up to higher positions such as Senior Financial Analyst, Accounting Manager, or Finance Manager. Many professionals also transition into specialized roles in taxation, auditing, or financial planning, which often come with higher salaries and more responsibilities.

Those who pursue certifications like Chartered Accountant (CA), Certified Public Accountant (CPA), or Chartered Financial Analyst (CFA) can access even greater career opportunities. With five to ten years of experience, Finance Account Specialists can advance to senior leadership roles such as Finance Director, Chief Financial Officer (CFO), or Financial Controller.

Some professionals choose to switch industries, moving from corporate finance to investment banking, consulting, or fintech. Additionally, individuals with strong analytical and strategic planning skills may explore roles in risk management, mergers and acquisitions, or corporate strategy, which offer significant career growth potential.

Conclusion

Preparing for a Finance Account Specialist job interview requires a combination of technical knowledge, strong analytical skills, and a deep understanding of financial regulations. Candidates must be well-versed in financial reporting, tax compliance, and accounting software to excel in this role.

Earning relevant certifications, gaining hands-on experience, and crafting a well-structured resume can significantly improve job prospects. Additionally, practicing common interview questions and staying updated on industry trends can help candidates make a strong impression during the hiring process.

This role offers excellent career growth opportunities, with pathways leading to senior finance positions such as Finance Manager, Financial Controller, and even CFO. Continuous learning and professional development play a crucial role in advancing within the finance industry.

With competitive salaries and strong demand across various industries, becoming a Finance Account Specialist can be a rewarding career choice. By staying proactive, improving technical expertise, and demonstrating strong problem-solving abilities, candidates can build a successful and long-term career in finance.

FAQs About Finance Account Specialist Job Interviews

1. What are the key skills required for a Finance Account Specialist role?

Answer: A Finance Account Specialist must have strong analytical skills, attention to detail, and proficiency in accounting software like Tally, QuickBooks, or SAP. They should also have a solid understanding of financial reporting, tax regulations, and compliance standards. Communication and problem-solving skills are also essential for collaborating with teams and resolving financial discrepancies.

2. What certifications can help me stand out as a candidate?

Answer: Certifications such as Chartered Accountant (CA), Certified Public Accountant (CPA), Chartered Financial Analyst (CFA), or Cost and Management Accountant (CMA) can significantly boost your credentials. Additionally, short-term courses in financial modeling, risk management, or forensic accounting can add value to your profile.

3. What common interview questions should I prepare for?

Answer: Be ready to answer technical questions like:

- How do you handle financial reconciliation?

- Can you explain the difference between accounts payable and accounts receivable?

- How do you ensure compliance with tax laws?

You may also face behavioral questions such as how you deal with tight deadlines or handle discrepancies in financial statements.

4. What should I include in my resume for this position?

Answer: Your resume should highlight relevant skills, work experience, and certifications. Include details on financial analysis, budgeting, and accounting software expertise. Use bullet points to list achievements, such as cost-saving initiatives or improvements in financial reporting efficiency. Tailor your resume to match the job description.

5. What is the average salary of a Finance Account Specialist in India?

Answer: The salary varies based on experience, location, and company. On average, entry-level Finance Account Specialists earn around ₹3-5 lakh per annum, while those with 5+ years of experience can earn ₹6-10 lakh per annum. In top firms, experienced specialists can earn even higher salaries.

6. How can I improve my chances of getting hired?

Answer: Gain hands-on experience with financial tools and software, stay updated on tax laws, and pursue relevant certifications. Networking through LinkedIn, finance forums, and professional groups can also help you connect with potential employers. Additionally, strong interview preparation and a well-crafted resume can make a significant difference.

7. What industries hire Finance Account Specialists?

Answer: Finance Account Specialists are in demand across multiple industries, including banking, IT, manufacturing, retail, healthcare, and government sectors. Large corporations, startups, and financial consultancies also require specialists to manage their accounts and ensure compliance with financial regulations.

8. What are the career growth opportunities for this role?

Answer: Starting as a Finance Account Specialist, professionals can move into senior roles such as Financial Analyst, Accounting Manager, or Finance Manager. With experience and additional certifications, they can advance to leadership positions like CFO, Financial Controller, or Director of Finance. Specialized roles in auditing, investment banking, and taxation are also potential career paths.

9. What challenges do Finance Account Specialists face in their roles?

Answer: Common challenges include managing tight deadlines, handling large volumes of financial data, ensuring compliance with tax laws, and staying updated with changing financial regulations. Strong time management and continuous learning are crucial to overcoming these challenges.

10. Is this role suitable for fresh graduates?

Answer: Yes, fresh graduates with a background in finance, accounting, or commerce can apply for entry-level positions. Gaining internships, learning accounting software, and pursuing additional certifications can improve job prospects. Many companies offer training programs to help new hires transition into the role smoothly.